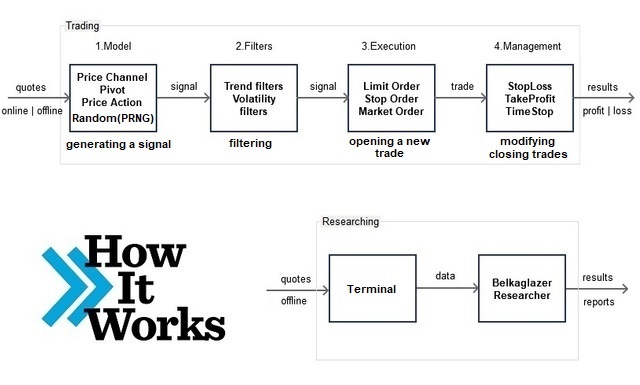

Belkaglazer EA is a complex Expert Advisor allowing traders to build diverse trading strategies in different markets (FOREX, FORTS, Crypto, Indices).

- The EA is based on 4 models with clear logic: PriceChannel, Pivot, PriceAction, PRNG;

- This is a sophisticated platform that can trade momentum, breakout, counter-trend, mean-reversion, scalping, and other strategies depending on settings or set-files;

- Supports Limit/Stop/Market orders, works with Instant/Market execution and automatically adjusts for 4 and 5-digit quotes;

- Contains CBOE VIX Filter. Advanced News Filter allows you to backtest the market impact of any news event. Automatic detection of GMT Offset;

- Works with different types of MM. Author’s strategies do not use Martingale, grid, hedging and other risky Money Management techniques; every trade is protected by stop-loss;

- Designed clearly and logically and provides tools for creativity and research. All settings/strategies are fully customizable;

- Provides additional options that can be configured via belkaglazer.ini file;

- Backtested with 99.9% modelling quality and variable spread. Backtest results match live trading.

Strategies (CurrentList)

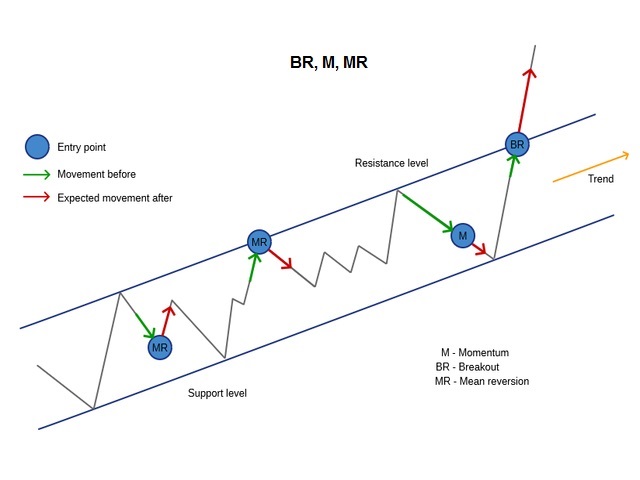

- Breakout [BR] is the price movement through certain support/resistance levels that prevent prices from moving lower/higher. The breakout strategy typically enters the market during periods of high volatility with a buy/sell pending stop order that is placed at a horizontal resistance/support level. A strong price movement may be a trigger for a breakout. Breakout[BR] trading is a form of Momentum[M] trading.

- Momentum [M] is a general class of strategies based on the continuance of current trends. The idea behind this strategy is that after a significant short term movement, the price will continue to move in the given direction until it loses strength. This strategy consists in buying/selling an asset after an unusually large upward/downward price movement. As a rule, it opens trades with a market order executed in the momentum direction.

- Mean Reversion [MR] is a general class of strategies based on the assumption that after a strong movement, the price will revert towards the mean (average value). This strategy is often referred to as counter-trend or reversal trading. It consists in selling/buying an asset after an upward/downward price movement. The strategy enters the market in the opposite direction with a pending limit or market order when the price comes close to a support/resistance level.

Models

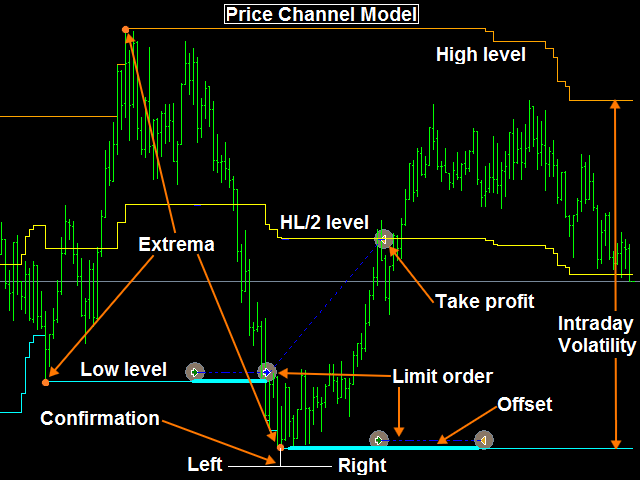

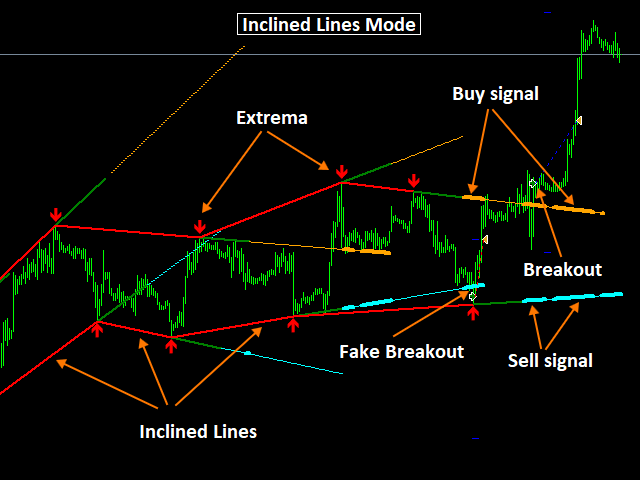

- Price Channel [PCh] model uses horizontal support [Low] and resistance [High] levels based on the minimal/maximum prices (extrema) confirmed during a certain period of time. The PCh model can be used as a breakout or mean-reversion strategy. It is possible to set/adjust the offset of the High/Low levels for optimization purposes. The optimal TP/SL levels for the MR/M are in the middle of the price range (HL/2 level).

– Inclined Lines (PCh Mode) [added in 1.79 version of the EA]. In this mode, the EA constructs two inclined lines (support and resistance levels) based on two confirmed extrema, forming a price range. The ‘ExpirationBars‘ parameter determines the maximum lifetime of an inclined line since its construction.

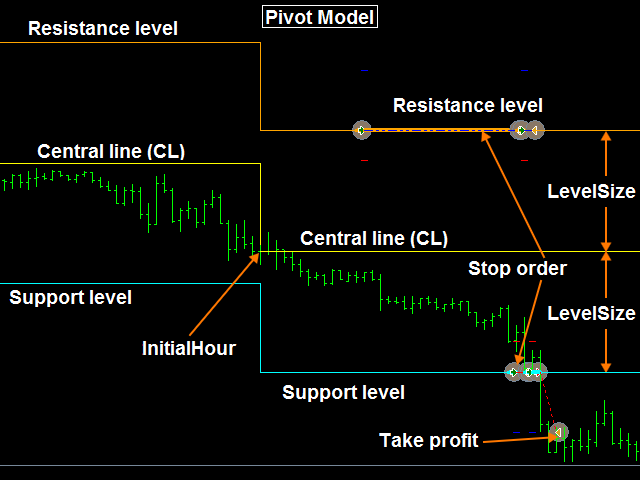

- Pivot model uses pivot points to determine critical support and resistance levels. The EA calculates the central line (CL) at a specified time (Initial Hour) using the following formula: CL = (Highest Price (Period)) + Lowest Price (Period) + Close Price At Specific Time) / 3. Support levels (SL) and resistance Levels (RL) are then calculated off this central line: SL = CL – a Percentage of the Daily ATR (Average True Range); RL = CL + a Percentage of the Daily ATR. The model can be used for building a breakout or mean-reversion strategy.

- Price Action [PA] model is based on the analysis of price movements over a certain period of time. The model identifies simple M/MR patterns and can be used to build a seasonal trading strategy.

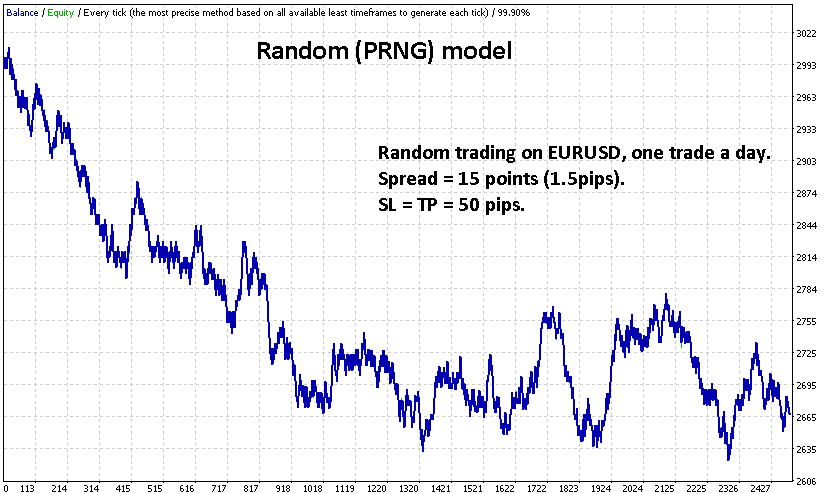

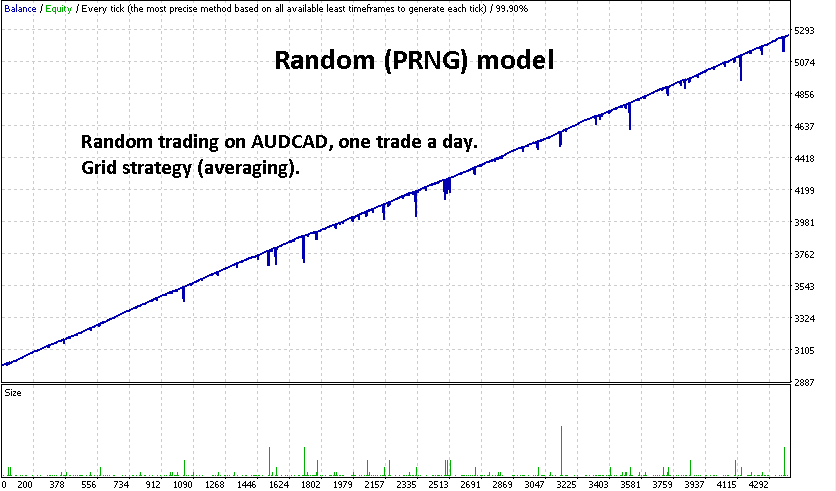

- Random (PRNG) model randomly generates trading signals in a random direction. This model can be used for various market studies, Monte Carlo experiments, as well as for making entry points together with Dangerous MM methods. ‘TradingFrequency (PRNG)‘ parameter allows you to adjust the trading frequency.

Download this example (requires v1.88x or higher): AUDCAD_M5_DMM.set

- None model allows you to turn the models off and generate signals based on filters.

Filters

Filtering is a way to improve the quality of trades and the performance of a strategy. Filtering reduces the number of trades and increases the profit factor. The filtered strategy has a higher Average Trade (Total Net Profit / Number of Trades). However, filters can’t turn a losing strategy into a winning one. Therefore, a good strategy should be profitable without filters. Using too many filters may result in over-filtering and curve-fitting!

The following filters can be used:

- Trend filters allow a strategy to open trades only in the direction of the overall trend, filtering out losing trades against the trend. Methods: Daily EMA, Daily HL/2.

- Volatility filters will ignore signals if the volatility is too high or too low. Methods: Intraday (width of the local price range), Daily (based on the daily ATR).

- Time Filters prohibit opening a new trade at a specific time (minute, hour, day of the week, month).

- News Filter is able to filter high/mid/low impact news events, provides an opportunity to backtest the impact of any news event and select various news data providers.

- CBOE VIX Filter is a US stock market crash filter that helps avoid drawdowns during market instability. It can be used in the strategy tester.

- Range/Hurst/RSI and other filters might help find good market conditions.

Execution

The buy/sell signal generated by a trading algorithm (model+filters) is executed as a limit/stop/market order. It is possible to set a delay in execution.

Open Positions Management

The trading system operates open positions using take profit, stop-loss, time-stop, trailing-stop, and other tools. The platform can work with different types of MM: Fixed lots, Proportional lots, %Margin, Max. risk per trade, Optimal F. There is an opportunity to add various dangerous methods of Money Management (Anti-Martingale, Martingale, Pyramiding, Averaging) to any strategy.

Research

Belkaglazer Researcher may help you with ideas for creating a new trading strategy.

Download presets