Belkaglazer EA platform allows you to use more than 10 diverse strategies on different markets: FOREX, CRYPTO, FORTS, INDICES.

The author’s set-files

— Last Updated: 22 April 2020 | v1.999b [What’s new in Presets]—

— Backtests Updated: 05 November 2019 —

*The backtests conduct with a fixed lot. No martingale, no grid, no hedging, and no dangerous elements of Money Management are used.

This table contains only a small part of set-files, a complete list can be found here: Presets.zip

| Strategies | Pairs | Presets / Backtests (clickable) Commission: $7 per one standard lot, round trip Live execution (TDS2 simulation), delay of 200-300ms |

| Daily_levels | ||

| The strategy uses price movement through an identified horizontal daily level of support or resistance. The strategy opens a trade during high volatility period when the price breaks through support/resistance levels.

XAUUSD (Gold) is more volatile than most currency pairs. Smaller lot size is recommended. |

EURUSD | 1-Stop[BR][PCh][v1.900][Daily_levels]_EURUSD_M30_L1.set |

| 1-Stop[BR][PCh][v1.900][Daily_levels]_EURUSD_M30_L1_(ATR).set | ||

| USDJPY | 1-Stop[BR][PCh][v1.900][Daily_levels]_USDJPY_M30.set | |

| XAUUSD | 3-Market[BR][PCh][v1.900][Daily_levels]_GOLD_M1_(NO2).set | |

| 3-Market[BR][PCh][v1.900][Daily_levels]_GOLD_M1_(NO3).set | ||

| Intraday_levels | ||

| The strategy opens trades during high volatility periods when the price breaks through Intraday support/resistance levels. | EURUSD | 1-Stop[BR][PCh][v1.900][Intraday_levels]_EURUSD_M60.set |

| 3-Market[BR][PCh][v1.900][Intraday_levels]_EURUSD_M60_(S) | ||

| USDJPY | 1-Stop[BR][PCh][v1.900][Intraday_levels]_GOLD_M60.set | |

| 3-Market[BR][PCh][v1.900][Intraday_levels]_GOLD_M1.set | ||

| Impulse_Intraday | ||

| The strategy uses significant price movement in one direction on high volumes. The strategy waits for strong price movement assuming that the market will continue to move in the same direction.

It has a low winning percentage of 30% – 40%. You can experience over 15 consecutive losses in a row. |

EURAUD | 3-Market[M][PA][v1.900][Impulse_Intraday]_EURAUD_M30.set |

| 3-Market[M][PA][v1.900][Impulse_Intraday]_EURAUD_M60_(S).set | ||

| EURUSD | 3-Market[M][PA][v1.900][Impulse_Intraday]_EURUSD_M15_(D3).set | |

| 3-Market[M][PA][v1.900][Impulse_Intraday]_EURUSD_M30_(S).set | ||

| 3-Market[M][PA][v1.900][Impulse_Intraday]_EURUSD_M60_(S).set | ||

| 3-Market[M][PA][v1.900][Impulse_Intraday]_EURUSD_M1_(60).set | ||

| GBPUSD | 3-Market[M][PA][v1.900][Impulse_Intraday]_GBPUSD_M15.set | |

| 3-Market[M][PA][v1.900][Impulse_Intraday]_GBPUSD_M30.set | ||

| 3-Market[M][PA][v1.900][Impulse_Intraday]_GBPUSD_M60.set | ||

| NY_CloseTrading *Please read the note at the bottom of the page |

||

| It is a classic mean reversion strategy. It places a pending limit order in the opposite direction of the price movement at the end of the North American Session (New York). The MR strategy assumes that the price will revert back towards the mean (average price).

This strategy has a low TP/SL ratio! It is recommended to switch it off during the high-impact Forex news events. |

AUDCAD | 0-Limit[MR][PCh][v1.900][NY_CloseTrading]_AUDCAD_M5.set |

| AUDNZD | 0-Limit[MR][PCh][v1.900][NY_CloseTrading]_AUDNZD_M5.set | |

| EURNZD | 0-Limit[MR][PCh][v1.900][NY_CloseTrading]_EURNZD_M5.set | |

| EURAUD | 0-Limit[MR][PCh][v1.900][NY_CloseTrading]_EURAUD_M5.set | |

| GBPCAD | 0-Limit[MR][PCh][v1.900][NY_CloseTrading]_GBPCAD_M5.set | |

| NZDCAD | 0-Limit[MR][PCh][v1.900][NY_CloseTrading]_NZDCAD_M5.set | |

| Scalping | EURCHF | 0-Limit[MR][PCh][v1.900][NY_CloseTrading]_EURCHF_M5.set |

| EURUSD | 0-Limit[MR][PCh][v1.900][NY_CloseTrading]_EURUSD_M5.set | |

| GBPUSD | 0-Limit[MR][PCh][v1.900][NY_CloseTrading]_GBPUSD_M5.set | |

| USDCAD | 0-Limit[MR][PCh][v1.900][NY_CloseTrading]_USDCAD_M5.set | |

| USDCHF | 0-Limit[MR][PCh][v1.900][NY_CloseTrading]_USDCHF_M5.set | |

| MondayTrading | ||

| The strategy enters a trade on Monday morning in the opposite direction to the price movement on Friday. It uses the difference in volatility between Friday and Monday (‘Weekend effect’). The volatility is higher than the average during the trading day on Friday and lower than the average during the trading day on Monday. | EURUSD | 2-Market[MR][PA][v1.900][MondayTrading]_EURUSD_M30_(M).set |

| GBPUSD | 2-Market[MR][PA][v1.900][MondayTrading]_GBPUSD_M30.set | |

| USDJPY | 2-Market[MR][PA][v1.900][MondayTrading]_USDJPY_M30.set | |

| IntradayMR | ||

| A simple Intraday mean reversion strategy. | EURUSD | 2-Market[MR][PCh][v1.900][IntradayMR]_EURUSD_M5_(S).set |

| 2-Market[MR][PCh][v1.900][IntradayMR]_EURUSD_M5_(HW).set | ||

| USDJPY | 2-Market[MR][PCh][v1.900][IntradayMR]_USDJPY_M5.set | |

| USDCAD | 2-Market[MR][PCh][v1.900][IntradayMR]_USDCAD_M30_(B).set | |

| FrontRunning | ||

| FrontRunning uses knowledge about the behaviors of a certain large group of market participants (when they enter or exit the market). For example, most ‘momentum’ traders will buy after closing a large bullish candle. Knowing this, you can enter the market a moment before the large candle is completely formed, and you may catch the price movement that ‘momentum’ traders create when they simultaneously buy an asset. | EURUSD | 3-Market[M][PA][v1.900][FrontRunning]_EURUSD_M1.set |

| 0-Limit[MR][PCh][v1.900][FrontRunningBR]_EURUSD_M30.set | ||

| Inclined_Lines | ||

| Inclined_Lines is a breakout strategy that uses the most recent support/resistance levels in the form of two inclined lines forming a price range. | EURUSD | 3-Market[M][PCh][v1.900][Inclined_Lines]_EURUSD_M60.set |

| GBPUSD | 3-Market[M][PCh][v1.900][Inclined_Lines]_GBPUSD_M60.set | |

| USDJPY | 3-Market[M][PCh][v1.900][Inclined_Lines]_USDJPY_M60.set | |

| AntiMomo | ||

| The strategy places a pending stop order after a strong momentum to catch a possible reversal. | EURUSD | 1-Stop[BR][PA][v1.900][AntiMomo]_EURUSD_M60.set |

| GBPUSD | 1-Stop[BR][PA][v1.900][AntiMomo]_GBPUSD_M60.set | |

| Strategies | Pairs | Presets / Backtests (clickable) MM risk settings: 0.25% per trade |

| Daily_levels | ||

| The strategy uses price movement through an identified horizontal daily level of support or resistance. The strategy opens a trade during high volatility period when the price breaks through support/resistance levels. | BTCUSD | 3-Market[BR][PCh][v1.900][Daily_levels]_BTCUSD_M5_L1_(ATR).set |

| Impulse_Intraday | ||

| The strategy uses significant price movement in one direction on high volumes. The strategy waits for strong price movement assuming that the market will continue to move in the same direction. | BTCUSD | 3-Market[M][PA][v1.900][Impulse_Intraday]_BTCUSD_M60.set |

| Inclined_Lines | ||

| Inclined_Lines is a breakout strategy that uses the most recent support/resistance levels in the form of two inclined lines forming a price range. | BTCUSD | 3-Market[M][PCh][v1.900][Inclined_Lines]_BTCUSD_M60.set |

| Strategies | Symbol | Presets / Backtests (clickable) Live execution (TDS2 simulation), delay of 200-300ms |

| Daily_levels | ||

| The strategy uses price movement through an identified horizontal daily level of support or resistance. The strategy opens trades during high volatility period when the price breaks through support/resistance levels. | fRTS | 3-Market[BR][PCh][v1.787][Daily_levels]_RTS_M15_L1.set |

| Impulse_Intraday | ||

| The strategy uses significant price movement in one direction on high volumes. The strategy waits for strong price movement assuming that the market will continue to move in the same direction. | fRTS | 3-Market[M][PA][v1.778][Impulse_Intraday]_RTS_M30.set |

| Intraday_levels | ||

| The strategy opens trades during high volatility periods when the price breaks through Intraday support/resistance levels. | fRTS | 3-Market[BR][PCh][v1.787][Intraday_levels]_RTS_M15_(S).set |

| US30 | 3-Market[M][PCh][v1.900][US30_Breakout]_US30_M30_(N).set | |

By default, the MT4 StopLoss is disabled in the ‘NY_CloseTrading‘ strategy on cross-pairs (e.g., AUDNZD) for an hour during the ‘rollover‘ (a low-liquidity time) because it can be activated due to the spread widening (for example, due to an increase from 3 to 40 pips), and this may lead to a big loss. The MT4 StopLoss cannot correctly protect an open position during a low-liquidity time.

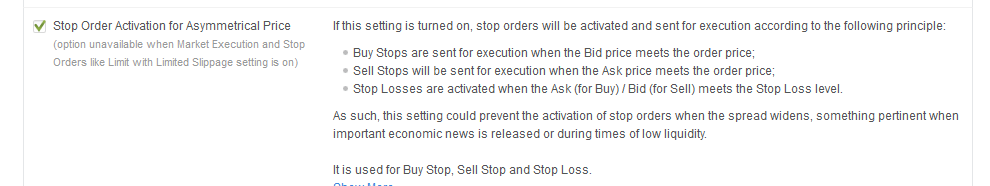

You can disable this option if your broker provides a similar feature:

Set ‘DisableSL_Hour‘ parameter to ‘-1‘

You also can turn off this option if you are sure that your broker does not widen spreads. Some brokers do not allow trading during the ‘FX rollover‘ by freezing prices for 2-5 minutes.

An example of the spread widening: