Belkaglazer EA is a platform allowing traders to build various trading strategies (momentum, breakout, mean-reversion) on different markets (forex, futures, stocks, indexes) based on 4 models, filters, and different types of MM.

Belkaglazer EA is a long-term system. My signals, strategies, and set-files do not use dangerous elements of Money Management. Therefore, there will be drawdowns, bad days/weeks/months, and maybe even a bad year. An equity curve will not look like a straight line with a 45-degree angle. If you use my strategies or set-files, make sure that you are prepared for a long stagnation period.

There are 3 basic steps.

Step 1: Choose the strategies

In the first step, you should choose the strategies you will use for trading. The presets currently contain more than 10 strategies divided into two basic types: Momentum[M] and Mean-Reversion[MR]. Breakout[BR] trading is a form of Momentum[M] trading.

M strategies:

- Daily_levels uses price movement through an identified horizontal daily level of support or resistance. The strategy opens a trade during high volatility periods when the price breaks through support/resistance levels.

Pairs: XAUUSD, EURUSD, USDJPY, BTCUSD. - Intraday_levels opens trades during high volatility periods when the price breaks through Intraday support/resistance levels.

Pairs: XAUUSD, EURUSD.

- Impulse_Intraday uses significant price movement in one direction on high volumes. The strategy waits for a strong price movement, assuming that the market will continue to move in the same direction.

***The Impulse_Intraday strategy has a low winning percentage of 30% – 40%. You can experience over 5-15 consecutive losses in a row. Please, make sure you’re prepared for such a losing streak!

Pairs: EURUSD, NZDUSD, GBPUSD, EURAUD, EURCAD, BTCUSD. - NewsPattern is a seasonal momentum-based strategy. It opens a trade during high-impact news events.

Pairs: NZDUSD, AUDNZD, EURNZD, EURAUD, EURCAD.

- PreviousDayHL. The strategy is based on a simple concept: if the price breaks yesterday’s high or low, then the price will move in the breakout direction.

Pairs: USDJPY. - Inclined_Lines is a breakout strategy that uses the most recent support/resistance levels in the form of two inclined lines forming a price range.

Pairs: EURUSD, GBPUSD, USDJPY, XAUUSD, BTCUSD.

MR strategies:

- MondayTrading. The strategy enters a trade on Monday morning in the opposite direction to the price movement on Friday. It uses the difference in volatility between Friday and Monday (‘Weekend effect’). The volatility is higher than the average during the trading day on Friday and lower than the average during the trading day on Monday.

Pairs: EURUSD, GBPUSD, USDJPY, USDCHF. - RollBackPattern. The strategy enters the market in the trend direction when the price approaches the mid-term support/resistance levels.

Pairs: EURUSD. - NY_CloseTrading is a classic mean reversion strategy. It places a pending limit order in the opposite direction of the price movement at the end of the North American Session (New York). The MR strategy assumes that the price will revert back towards the mean (average price).

Pairs: EURUSD, AUDNZD, AUDCAD, EURNZD, GBPCHF, GBPCAD, GBPUSD, USDCHF, EURAUD, GBPAUD, NZDCAD.

- IntradayMR. It’s a simple Intraday MR strategy.

Pairs: USDJPY, GBPUSD, XAUUSD, EURUSD, USDCAD.

- AntiMomo. The strategy places a pending stop order after a strong momentum to catch a possible reversal.

Pairs: EURUSD, GBPUSD.

I recommend to backtest strategies with fixed lots. You can use my reports in this shared folder. The more strategies you use, the less your risk, and the better you can trade in different market regimes (trend/flat).

I also recommend changing the default settings for the ‘TakeProfit’, ‘StopLoss’, ‘StopBar’ parameters. This will help you avoid slippage and situations where the price comes very close to the TP level but does not hit it for a long time.

Also, you can set up a trailing stop (see ‘TrailingStopPip‘ parameter) to protect the floating profit. Remember to do a new backtest with the changed settings.

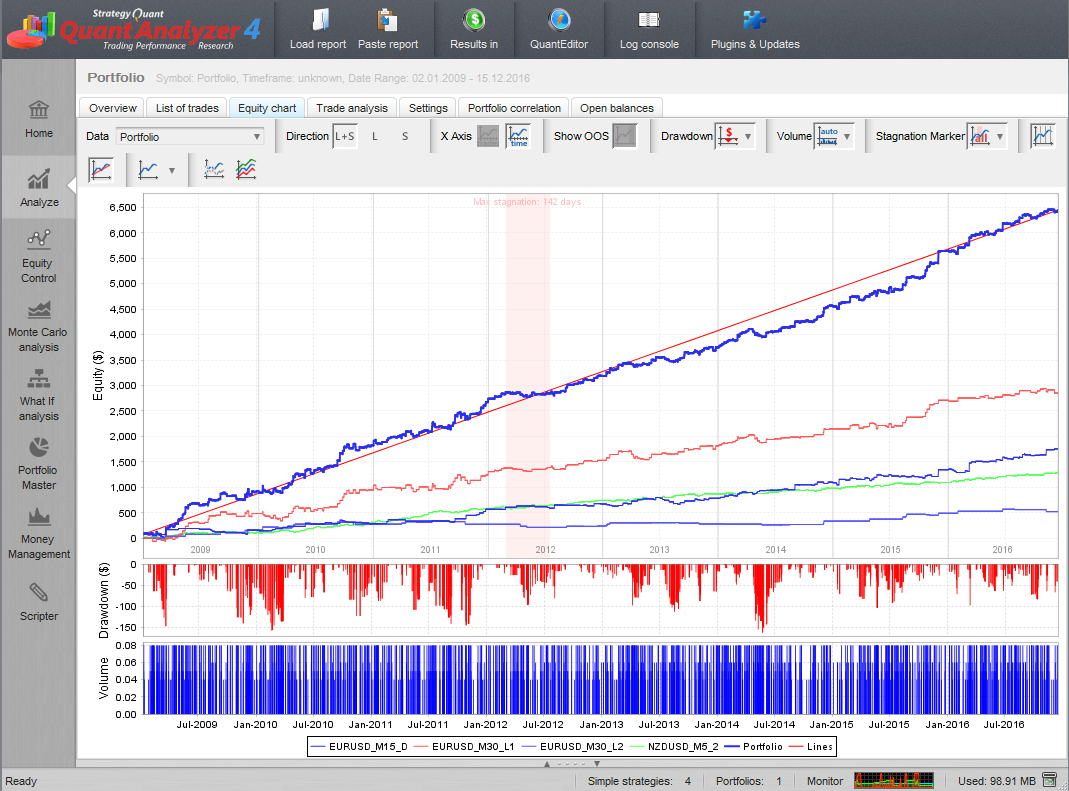

Step 2: Create&Test a portfolio

In this step, you need to determine the lot size for each strategy and build an optimal portfolio. I recommend using QuantAnalizer (free version) to merge backtests into a single portfolio.

I recommend using 0.01…0.03 lots for every $1.000

Keep in mind that you need to divide trading risks between presets based on the same strategy.

See also Overlap Matrix

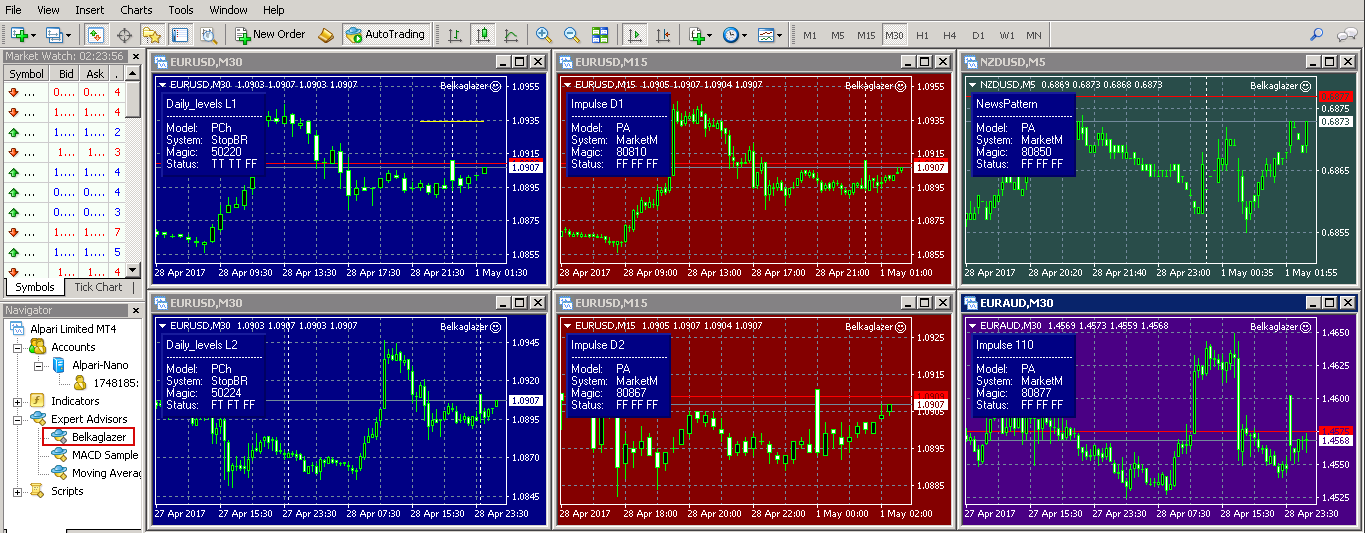

Step 3: Install the EA in MT4

Now you need to install the chosen presets/strategies on separate charts in the MetaTrader 4 terminal. It’s necessary to open a new chart for every set-file. For example, if you want to use the EA with 6 different presets/strategies, you should open 6 charts and attach the EA to each of them:

- Look for the Expert Advisors section under the Navigator panel on the left side of the terminal. Click on the + (plus) sign.

- Click on the EA and drag it onto one of the charts.

- Select the Input tab of the Properties window, then press Load, select the preset file, press Open.

- If necessary, configure the Money Management, GMT_offset, and other parameters, then press OK.

- Make sure that automatic trading is enabled, and you see a smiley face in the right-top corner of the chart.

- Repeat 1-5 for each preset file.

If you use two or more presets/strategies on the same MT4 account, you should set a unique Magic Number for each EA instance.

At first, I recommend trading your portfolio on a demo account to ensure it works аs expected.