Criteria for portfolio composition

1. Choose strategies with good performance. Remember, a spoonful of tar can spoil a whole barrel of honey. The more strategies you use, the higher the diversification, the lower the profit, max. drawdown, volatility of your portfolio. The more strategies you use, the less your risk, and the better you can trade in different market regimes.

2. Allocate a certain trading lot size for each strategy (not for a set-file). For example, 0.04lots on every $1000. Divide this lot size between set-files based on the same strategy, as they may be highly correlated, especially if they use the same pair. For example, if you want to use 4 presets of ‘Daily_levels‘ strategy, then the lot size for each preset should be 0.01lots on every $1000 (0.04/4 = 0.01).

3. Don’t give a significant trading advantage (for example, a larger lot size) to any strategy because sooner or later, any strategy will fail. If the failed strategy has a larger lot size, it will be difficult for others to cover losses.

4. The expected profit ratio of M/MR strategies should be at least 70%/30%. For example, the expected profit of M in a portfolio is 100, MR is 50. The ratio = 67%/33%.

5. Your portfolio should withstand a long losing streak. No doubt, such a streak will occur in the future. So multiply your estimated MDD by 2-3 times to cover the survivor bias.

Reliable backtest results

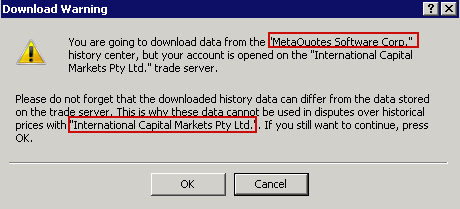

Good backtests require accurate historical data, but most brokers don’t provide their own historical data. They usually provide poor quality data from Metaquotes:

I know two ways to test with high quality.

1) The first way is to use the TDS2 software with the Dukascopy tick data and real variable spreads (Unfortunately, TDS2 is not for free).

2) The second one is to use the Alpari MT4 terminal (it’s for free). Alpari provides some of the best historical data. They close daily charts at 5 pm New York time. Just open a demo account through MT4 and download their data via ‘History Center‘.

Optimization

Please read: https://belkaglazer.com/en/belkaglazer-en/how-to-build-a-strategy-en